Frustrated watching competitors launch products while you’re stuck waiting for your traditional PAS vendor to approve system integrations?

You need your Policy Administration System to connect seamlessly with claims, billing, underwriting tools, analytics platforms, and partner portals. That’s what integration means: making your PAS the central hub that shares data with every critical system in real-time. But when you submit a “simple” API request to connect your claims system, your traditional PAS vendor says “Q3 2026 roadmap, maybe.”

Meanwhile, your bordereaux reports take weeks because your PAS can’t pull from multiple systems automatically. Your MGA partners wait months for portal access because your traditional PAS vendor controls every connection point.

You’re right to be angry.

According to Boost Insurance (2024), even basic PAS implementations take a year for a single product line. Traditional PAS vendors charge you just for the privilege of waiting. Traditional PAS vendors built their entire business model on controlling your PAS integrations. They decide when your Policy Administration System connects to other systems.

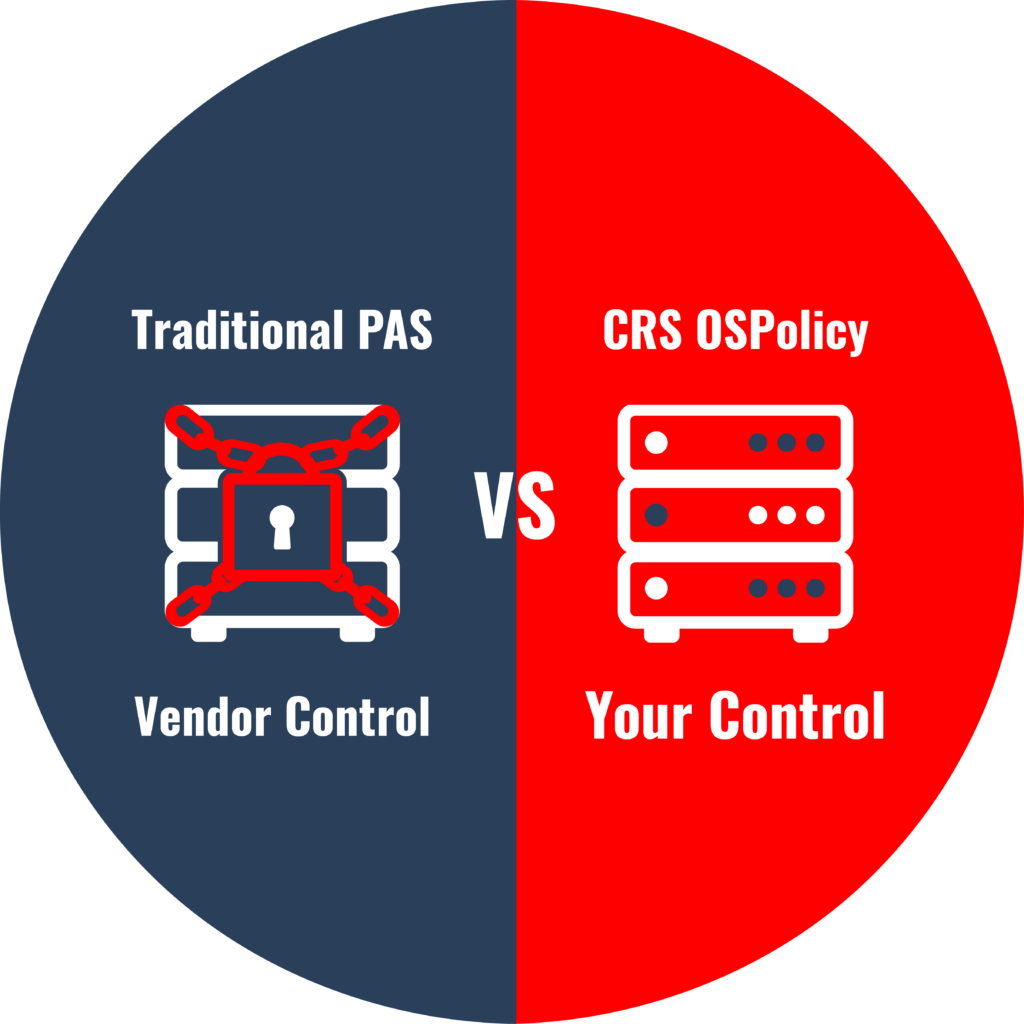

It’s time to take back control.

The Hidden Business Model: Traditional PAS Vendor Control as Revenue

Your traditional PAS vendor isn’t slow because integration is hard. They’re slow because controlling your Policy Administration System’s connections is their business model.

Every disconnected system means another “professional services” engagement. Every data silo between your PAS and other platforms requires expensive middleware. Every delayed PAS integration keeps you locked in their ecosystem.

Research from Wissen (2024) reveals that data silos between PAS and other systems cost insurance employees 12 hours every week. For a mid-sized P&C carrier with 500 employees, that’s 312,000 hours annually lost to traditional PAS vendor-imposed inefficiency.

When underwriters can’t access real-time claims data through PAS integration, you’re either overpricing and losing business or underpricing and bleeding money. According to Info-Tech Research Group (2024), 60% of insurers are desperately investing in modernization, trying to work around traditional PAS vendor limitations.

The True Price of Traditional PAS Vendor Lock-in

IDC research shows data management alone accounts for $41.1 billion in IT infrastructure spending, much wasted on working around traditional PAS vendor-imposed integration limitations.

Lost Market Opportunities: While you wait 18 months for that API connection, insurtechs launch three lines of business. Your innovative excess liability product sits in integration purgatory.

Partner Frustration: Your best MGA moves their $50M book to a competitor with real-time quoting through instant PAS-to-portal integration. Your reinsurance partner needs immediate exposure data from your PAS. Traditional PAS vendor says 2027.

Data Quality Disasters: When your PAS can’t communicate with claims, underwriting, and billing in real-time, you get duplicate policies, inconsistent records, and reporting nightmares.