To Know Me Is To Trust Me – The Truth About Trust and Technology.

By Combined Ratio Solutions October 11th, 2021

So You Think You Know What Trust is Mr Bond?

At Combined Ratio we say, “It's Time To Know Your Agents & Brokers.” At the start of this blog series, we also reminded you of the old phrase “my word is my bond.” Success in “knowing your broker” and enabling them to better service the policy holder, has been traditionally achieved through relationships built on trust and managed with the intangible “know how” of your best sales, marketing, and underwriting professionals. As things change and people move in and out of the profession its vital to preserve those most performant relationship skills. We argue that while there’s clearly a role for technology in this (and our technology “CRS Impact” helps you know your broker’s better) we have been around the insurance industry long enough to understand that we need to find the right balance. Resist the almost overwhelming forces of lurching to a technology only answer, and as Tom Hammond says in Insurance Thought Leadership “Technology alone won’t solve the trust problem.” That approach ignores the importance of the relationship and the foundation of that relationship…trust.

Trust and Time

Trust is about having a confident relationship with the future, or a confident relationship with the unknown. Trust is one side of a coin. The other side of that coin is risk – an idea which is the very foundation of the insurance industry. The idea of trust has evolved over the years. Originally it was “local” – we trusted people and things that had proximity to us that existed in our local community. Think churches and yes…pubs for example. Things and people we knew. As we became more spread out, we moved onto institutional trust. Institutions are not just physical structures but are ideas and intangible formations that “within which we organize ourselves” [1]. Think marriages, families, currencies, and promises (like “my word is my bond.”) Institutional trust hasn’t been doing so well lately. In fact, trust in certain institutions and professions is at an all time low. Then we come to distributed trust, which is technology based (or at least assisted), and is where we find ourselves heading into today. So, if the other side of trust is risk, and we’re entering the period of technologically enabled distributed trust, where does this leave us? Let’s figure what trust is before we go there and figure out the role of technology in trust.

What is Trust?

Trust is one of the most widely accepted and generally poorly understood ideas in life and business. No one would admit to not knowing what trust is. If you ask someone if they trust someone else, when they justify whether they do or don’t, they tend to use a lot of intangibles, undefinable ideas that really go back to gut feel and intuition. We’ve been proven wrong too many times using those tools, and we’ve seen the decline of institutional trust.

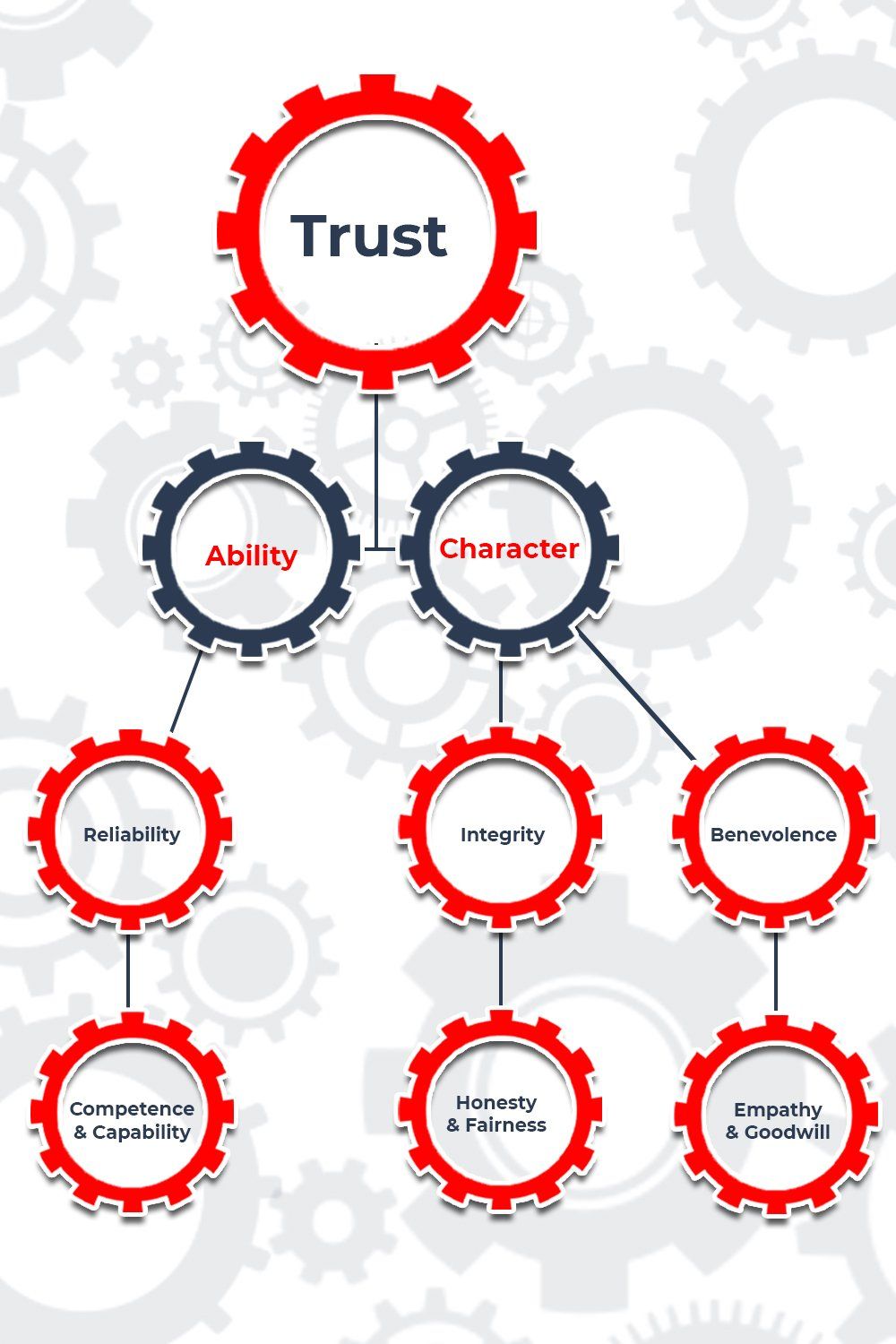

Trust is made up of Ability plus Character. Ability is made up of Capability and Reliability. Character is made up of Integrity and Benevolence. Some of the constituent parts of trust seem obvious and some less so. For example, Ability is made up of Capability (you possess the capabilities to perform a certain task). In the insurance world that would mean that the agency and the Carrier have the knowledge and expertise to write certain policies undertaking certain risks. They then must also be Reliable – they’ll be there when you need them. You can depend on them. In the insurance world that means when that stuff that’ll never happen…happens.

Trust and Technology

Where’s the technology angle on all this? In our last blog we concluded that we could use technologies to identify, improve, institutionalize, codify and scale successful behaviors and relationship skills. There are just too many things going on in too many places for us to rely on manual methods. And as we’ve said before, if enough of the tribe exit taking their tribal knowledge with them, then “Houston we have a problem.”

From the carrier standpoint how does our technology advance the cause of trust? CRS Impact is used to support, or refute, behaviors that result in exceptional agent performance. What are we doing and “not” doing that’s enabling our brokers to win more “good” business and avoid the “bad” business? That’s the data CRS Impact is gathering from your existing systems. It’s unavoidable that in doing this, that same technology is supporting the idea of distributed trust. Impact is identify analyzing data and codifying reliable, competent behaviors that I can then trust to protect existing business and win new business. The data we have gathered better enables our integrity. It means we can be rightfully confident that we can “Say what we mean” (knowing we have the data to support our conclusions) and can therefore “mean what we say.” We are better placed to understand which behaviors of our sales, marketing and underwriting professional lead to the best outcomes and we can stand behind them knowing that we can trust these conclusions.

“The Combined Ratio” - What This Means to You and Your Team

So maybe we’ve entertained the idea of combining a different ratio in this blog. Previously we’ve focused on combining for the right ratio of technology and know-how, transformation and adaptation and now trust and technology. In this case we’re suggesting that you can use technology (specifically our Agent Engagement Platform – CRS Impact) to work within the foundations of ability and character to build trust – the very basis of any viable relationship. And as we’ve said the role of technology must be additive to the relationship. Better enabling it rather than trying to replace it.

Let’s be clear here. We’ve consistently argued for balance. The right ratio of technology and people, of technology and relationship of technology and knowhow. “It’s humans who make trust possible. It’s not just technology or mathematics. If we do find ourselves in a world so automated that we depend solely on machines and algorithms to make decisions about who we trust, that’s a world devoid of uncertainty.” Rachel Botsman – Who Can You Trust” A world devoid of uncertainty means a world without risk and that might mean less or no insurance. Yet if we’ve established nothing else in this blog, surely it is that if we buy the definition of “trust” being “a confident relationship with the future”, isn’t that exactly what insurance does? Help us establish that confident relationship with the future making trust and insurance intertwined. We accept that there’s a role for technology establishing and preserving the idea of trust in the modern world, we’re just saying that just as relationships and business transformations are not the sole domain of technology, neither is the idea of trust.